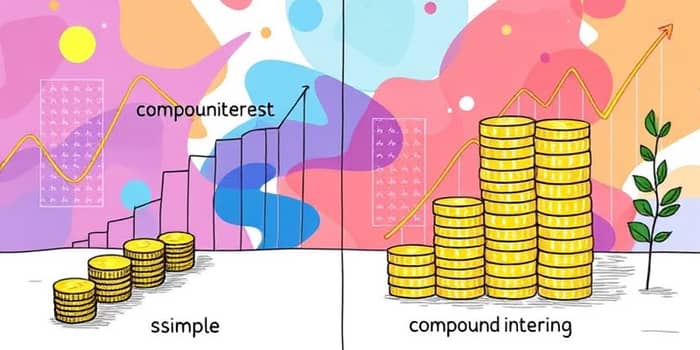

In finance, interest is a powerful force that shapes wealth and debt. Understanding its two main forms can transform your financial decisions.

Simple interest offers linear and predictable growth, making it easy to manage. Compound interest, however, can lead to exponential wealth accumulation over time.

This guide will help you navigate these concepts with clarity. You'll gain practical insights for saving and borrowing wisely.

What is Simple Interest?

Simple interest is calculated only on the initial principal amount. This results in a constant interest payment each period.

The growth pattern is straightforward and linear. For example, a $1,000 investment at 5% earns $50 annually.

The formula is I = P × R × T / 100. Here, P is principal, R is rate, and T is time in years.

- Calculation is based on principal only.

- Interest remains consistent over time.

- Commonly used for short-term financial products.

This simplicity makes it accessible for beginners. It's ideal for loans where costs need to be predictable.

Understanding Compound Interest

Compound interest calculates on the principal plus accumulated interest. This creates an exponential growth effect.

Often called "interest on interest," it accelerates returns. Over long periods, it can significantly boost savings.

The formula is A = P (1 + r/n)^(nt). A is the final amount, r is the decimal rate, n is compounding frequency, and t is time.

- Growth builds on previous interest earnings.

- Frequency of compounding impacts total returns.

- Best suited for long-term investments.

This makes it a key tool for building wealth. However, it can also increase debt quickly for borrowers.

Key Differences Between Simple and Compound Interest

To compare them clearly, here is a table summarizing essential features.

This table highlights why compound interest is favored for savings. It also shows the risks for borrowers with high-interest debt.

Real-World Examples to Illustrate the Concepts

Let's explore practical scenarios. For simple interest, a $10,000 loan at 5% for 3 years yields $1,500 interest.

With compound interest, $1,000 at 5% compounded annually grows to $1,102.50 in two years. Interest earns more interest each period.

- Simple example: $100 at 5% for 5 years totals $125.

- Compound example: $5,000 at 5% monthly for 10 years reaches ~$8,235.

- Borrower caution: Compound loans can become rapidly increasing debt.

These examples demonstrate the power of compounding. Early savings can leverage this for substantial growth.

Pros and Cons for Financial Planning

Weighing advantages and disadvantages helps in decision-making. For simple interest, pros include easier calculation.

Cons involve lower returns for savers. For compound interest, pros focus on higher growth potential.

- Simple interest pros: predictable payments, lower borrower cost.

- Simple interest cons: Limited savings growth, less effective long-term.

- Compound interest pros: Accelerated wealth building, benefits from frequency.

- Compound interest cons: Complex calculations, risk of debt spirals.

By understanding these, you can tailor strategies to your goals. This knowledge is essential for financial success.

Applications in Everyday Financial Products

Both interest types are used across various instruments. Simple interest is common in personal loans.

It also appears in some auto loans and short-term deposits. Compound interest dominates savings accounts.

- Simple interest applications: Mortgages, student loans, short-term notes.

- Compound interest applications: Retirement funds, investment portfolios, credit cards.

Beyond finance, it models natural phenomena like population growth. This shows its universal exponential nature.

The Impact of Compounding Frequency

Frequency refers to how often interest is calculated. More frequent compounding increases returns.

For instance, monthly compounding yields more than annual. This can make a significant difference over time.

- Annual compounding: Simpler but slower growth.

- Monthly or daily compounding: Faster accumulation, higher totals.

Choosing accounts with higher compounding frequencies maximizes benefits. It's a smart move for savers.

Practical Advice for Using Interest to Your Advantage

Implement these tips to enhance your financial health. Start saving early to harness compound interest.

Avoid high-interest debt that compounds quickly. For loans, prefer simple interest when possible.

- Begin investing young for long-term growth.

- Pay off credit cards to prevent debt buildup.

- Use compound interest for goals like retirement.

- Select savings accounts with favorable compounding.

- Review financial products regularly for optimization.

These actions can lead to sustainable wealth creation. They empower you to take control of your finances.

Conclusion: Empowering Your Financial Future

Mastering simple and compound interest is a cornerstone of financial literacy. Simple interest provides stability and predictability.

Compound interest offers the potential for exponential growth. Understanding when to use each can transform your economic outlook.

Apply this knowledge to save wisely and borrow cautiously. Let time and compounding work in your favor for a prosperous tomorrow.

References

- https://www.amerantbank.com/ofinterest/simple-interest-vs-compound-interest/

- https://byjus.com/maths/compound-interest/

- https://www.westernsouthern.com/investments/simple-interest-vs-compound-interest

- https://www.pnc.com/insights/personal-finance/save/what-is-compound-interest.html

- https://www.thrivent.com/insights/investing/simple-vs-compound-interest-explained

- https://www.westernsouthern.com/investments/how-does-compound-interest-work

- https://www.neofinancial.com/blog/simple-vs-compound-interest

- https://www.fidelity.com/learning-center/trading-investing/compound-interest

- https://www.axis.bank.in/blogs/generic/simple-interest-vs-compound-interest

- https://moneysmart.gov.au/saving/compound-interest

- https://www.embers.org/calculator/simple-vs-compound-interest-calculator

- https://www.idfcfirst.bank.in/finfirst-blogs/savings-account/what-is-compound-interest

- https://www.youtube.com/watch?v=OrJnq_W0x6I

- https://www.bankrate.com/banking/what-is-compound-interest/

- https://betterexplained.com/articles/a-visual-guide-to-simple-compound-and-continuous-interest-rates/