In the ever-evolving world of global finance, frontier markets stand as beacons of untapped potential, offering a path to diversification and growth.

These economies, more advanced than least developed countries yet not quite emerging, present a unique blend of high rewards and significant risks.

For adventurous investors, understanding frontier markets can unlock doors to demographic-driven growth in regions poised for transformation.

This article will guide you through their definition, history, opportunities, and the specific risks involved, providing practical insights for making informed decisions.

By the end, you'll have a clearer picture of how to approach these dynamic markets with confidence and caution.

What Are Frontier Markets?

Frontier markets are developing economies that fall between least developed and emerging markets in terms of advancement.

They are characterized by underdeveloped financial infrastructures, such as low liquidity and small market capitalizations, which can limit foreign investor access.

These markets often exhibit higher political and economic instability compared to more mature economies.

Despite this, they are driven by local domestic consumption, though some export-reliant ones may correlate with global forces.

Key traits include thin liquidity, currency swings, and sensitivity to political shifts, making them both volatile and full of promise.

To better understand their nature, consider these essential characteristics:

- Underdeveloped equity markets with limited foreign access

- Small market capitalizations and illiquid trading environments

- Higher exposure to political and economic risks

- Growth often fueled by young, growing populations

Recognizing these features is the first step toward evaluating their investment appeal.

The History and Evolution of Frontier Markets

The term "frontier market" was coined in 1992 by Farida Khambata of the International Finance Corporation.

It was used to describe smaller markets tracked in the Emerging Markets Database, which later evolved into indices by S&P, MSCI, and others.

Over time, these markets have been labeled as pre-emerging economies, indicating their potential to graduate to emerging status.

Some countries have regressed from emerging to frontier, highlighting the dynamic nature of these classifications.

This history underscores the importance of staying updated on market evolutions and index provider criteria.

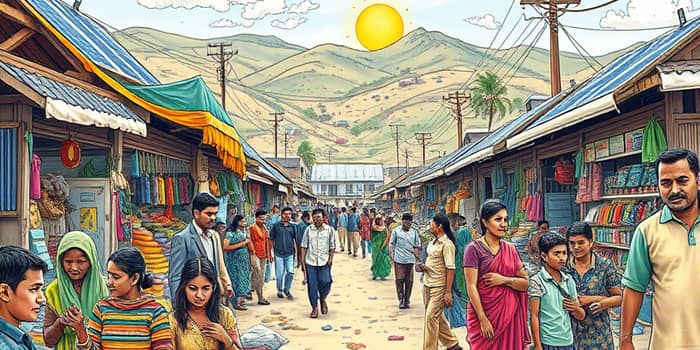

A Global Snapshot of Frontier Markets

Frontier markets span diverse regions, from Gulf states like Bahrain to African nations like Kenya and Vietnam.

Major index providers such as FTSE, MSCI, S&P, and Russell classify them variably, leading to a complex landscape.

Here is a list of key countries often considered frontier markets, based on common classifications:

- Argentina, Bahrain, Bangladesh, and Botswana

- Côte d'Ivoire, Croatia, Estonia, and Ghana

- Jordan, Kazakhstan, Kenya, and Kuwait

- Nigeria, Oman, Pakistan, and Vietnam

- Others like Romania and Slovenia also feature prominently

This diversity means investors must research specific countries to understand their unique opportunities and challenges.

For a comparative view, the table below contrasts frontier markets with emerging and developed markets across key aspects.

This comparison helps contextualize where frontier markets fit in the global investment spectrum.

Unlocking Investment Opportunities

Frontier markets offer compelling opportunities for those willing to embrace their complexities.

They are driven by factors like young populations and economic liberalization, which can lead to substantial growth.

Diversification benefits arise from their low correlations with developed markets, reducing overall portfolio risk.

To capitalize on these opportunities, consider the following key areas:

- High growth potential from demographic dividends and low debt burdens

- Exposure to domestic consumption trends and supply chain shifts

- Digitization efforts boosting productivity in sectors like finance

- Long-term returns that can outpace more mature markets

Investors can access these through vehicles like ETFs or indices focused on large, liquid stocks.

By focusing on regions with strong fundamentals, you can tap into untapped potential that others might overlook.

Navigating Specific Risks and Challenges

While opportunities abound, frontier markets come with elevated risks that require careful management.

These risks are qualitatively different from those in emerging or developed markets, often involving higher volatility.

Key challenges include political instability, illiquidity, and regulatory uncertainties that can impact investments.

Here are the primary risks to be aware of:

- Political and social instability leading to prolonged crises

- Illiquidity risks from small companies and trading limits

- Currency and commodity dependencies affecting economic stability

- Access constraints with limited international financing options

- Regulatory volatility and weak institutional frameworks

Understanding these risks is crucial for developing strategies to mitigate them, such as diversifying across countries or using hedges.

Always conduct thorough due diligence to avoid unexpected pitfalls in these dynamic environments.

Practical Steps for Investing in Frontier Markets

For investors looking to venture into frontier markets, a methodical approach is essential.

Start by assessing your risk tolerance, as these markets are not suitable for everyone due to their complexities.

Research specific countries and sectors that align with global trends, such as technology or consumer goods.

Consider using investment vehicles that offer exposure while managing risks, like broad-based ETFs.

Here are actionable steps to guide your journey:

- Educate yourself on local economic and political conditions

- Diversify investments across multiple frontier markets to spread risk

- Monitor index provider classifications for updates on market status

- Focus on long-term horizons to ride out short-term volatility

- Consult with financial advisors experienced in emerging economies

By following these steps, you can build a resilient portfolio that leverages high growth prospects while safeguarding against downsides.

Remember, patience and continuous learning are key in navigating these frontiers.

Embracing the Frontier Journey

Frontier markets represent a frontier of opportunity in the global investment landscape.

They challenge conventional wisdom with their unique blend of risk and reward, offering a chance for significant returns.

As economies evolve and digitization spreads, these markets may graduate to emerging status, providing early investors with first-mover advantages.

Stay informed, be adaptable, and approach with a balanced perspective to make the most of what frontier markets have to offer.

With careful planning, you can turn these challenges into stepping stones for financial growth and diversification.

References

- https://en.wikipedia.org/wiki/Frontier_market

- https://www.aberdeeninvestments.com/en-hk/investor/insights-and-research/exploring-frontier-markets-investment-insights-and-challenges

- https://www.pholus.co/what-is-a-frontier-market-and-why-you-should-be-skeptical-of-the-term/

- https://www.blackrock.com/uk/solutions/investment-trusts/our-range/blackrock-frontiers-investment-trust/trust-information/insights/are-investors-overlooking-undervalued-frontier-markets

- https://www.assetmanagement.hsbc.nl/en/professional-clients/capabilities/equities/frontier-markets

- https://moneyfortherestofus.com/frontier-markets/

- https://www.weforum.org/stories/2024/04/five-surprising-facts-about-investing-in-frontier-markets/

- https://www.oecd.org/en/blogs/2025/09/Investing-in-frontier-markets--What-DFIs-need-to-know.html

- https://globaledge.msu.edu/econ-class/frontier-markets

- https://www.bii.co.uk/en/what-we-have-learned-about-investing-in-frontier-markets/

- https://www.westernasset.com/us/en/research/blog/frontier-markets-ready-to-break-on-through-2023-10-10.cfm